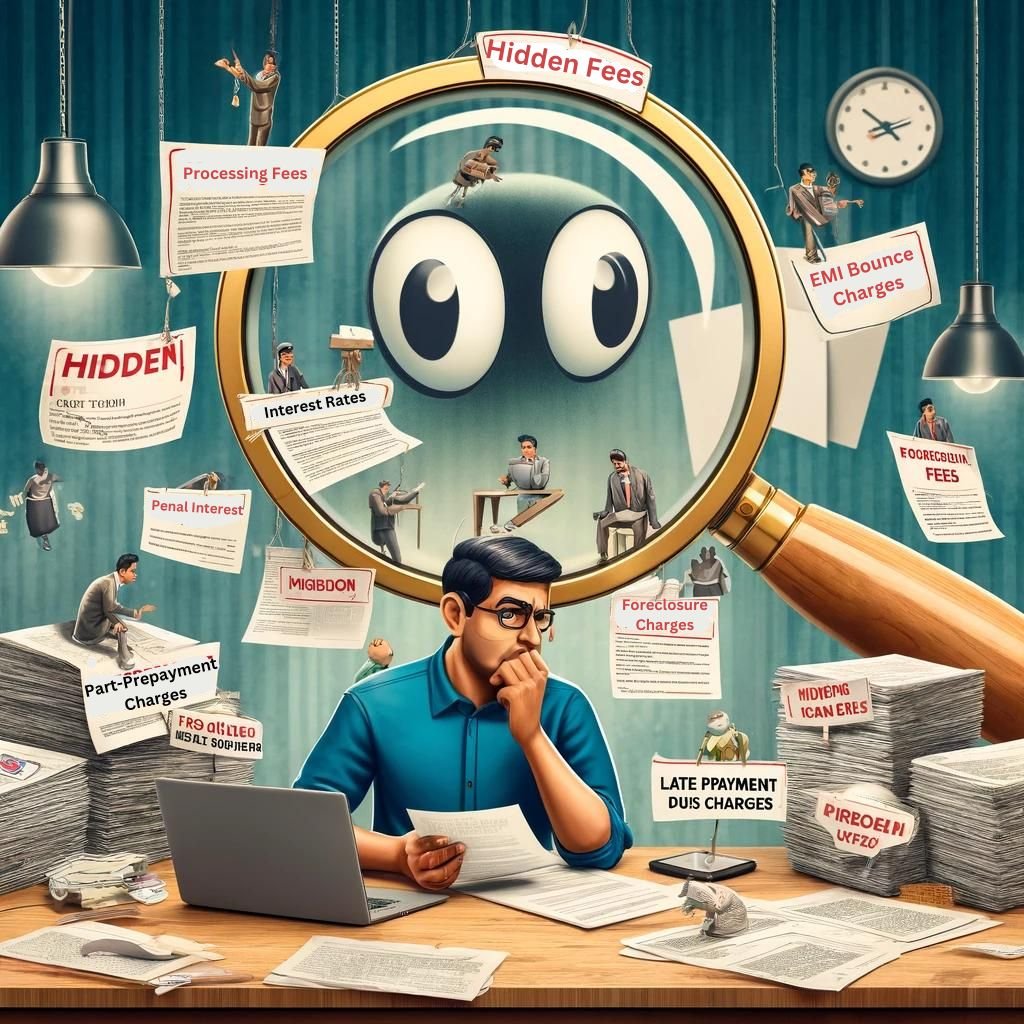

Unveiling the Hidden Costs of Personal Loans: What You Need to Know

If you’re looking at a personal loan to achieve your dreams, it’s essential to look beyond the headline interest rates. Personal loans can indeed be a financial lifeline, but they come with various charges that could impact your overall borrowing costs. In this guide, we’ll explore these potential fees so you can make an informed decision when selecting a personal loan.

Understanding the Fees Associated with Personal Loans

- Processing Fees – Often referred to as the loan origination fee, processing fees cover the lender’s expenses for evaluating and approving your loan application. Typically, this fee is a percentage of the total loan amount, averaging around 3.93%. It’s important to factor this into your calculations when determining the total cost of your loan.

- Interest Rates

The most significant cost of any loan is the interest rate. This is the annual percentage that you’ll pay on the loan amount, which is incorporated into your monthly EMIs (Equated Monthly Installments). The interest rate varies significantly between lenders (Banks/NBFC) and is influenced by factors such as your credit score and the loan term.

- EMI Bounce Charges

If you miss an EMI payment, be prepared for a penalty. These charges range between Rs. 700 and Rs. 1,200, serving as a deterrent against late or missed payments.

- Penal Interest

In addition to EMI bounce charges, late payments can attract an additional interest charge on the outstanding amount, which can be as high as 3.50% per month. This makes timely payments crucial for managing your loan cost-effectively.

- Beyond the Basic Fees

- Foreclosure Charges

- If you decide to close your loan early, you might face foreclosure charges. These fees are generally a nominal percentage of the remaining principal and are intended to compensate the lender for the interest they will forfeit due to the early closure.

- Part-Prepayment Charges

- Should you wish to prepay part of your loan, there may be a charge for this option, which can be up to 4.72%. However, it’s worth noting that such charges often do not apply to Flexi loans.

- Foreclosure Charges

Why Do Lenders Charge These Fees?

Processing fees help lenders cover the administrative and operational costs associated with loan evaluation and approval. These fees are crucial for maintaining a profitable lending operation while offering competitive loan products.

Finding the Right Loan for You

Compare Offers

It’s wise to shop around and compare processing fees, interest rates, and other charges from different lenders or with a company like BluePapers. This can help you find the most cost-effective loan that meets your financial needs.

Negotiate Fees

Depending on your credit score and the lender’s policies, you or BluePapers might be able to negotiate certain fees, like processing charges, to lower your overall borrowing cost.

Take Control of Your Financial Decisions

By understanding these hidden charges, you can approach personal loans with greater confidence and knowledge. Use this insight to compare loan offers, negotiate better terms, and choose the loan that best suits your financial situation. Always remember to read the loan agreement thoroughly to ensure you are fully aware of every potential fee.

Taking out a personal loan doesn’t have to be daunting. With the right knowledge and preparation, you can secure a loan that not only helps you meet your immediate financial goals but also aligns with your long-term financial health.